Over the past two years, various regions throughout the country have carried out renovation & ldquo; scattered Pollution & rdquo; enterprise work, according to incomplete statistics, the cumulative management of & ldquo; scattered Pollution & rdquo; the number of enterprises as high as more than 100,000. In September 2019, all the renovation work will be basically completed. Environmental protection requirements are becoming stricter and stricter, and the survival pressure of textile enterprises is increasing. Overall, due to various factors, the situation of textile enterprises is still a long way to go.

1. Strictly Strike Down Environmental Protection Tax

In April 2018, Dongguan formulated and implemented the "Operation Plan for Blue Sky Defense in Dongguan City", which comprehensively launched the statistics of Blue Sky Defense War, and cleared up a total of 13073 enterprises, of which 9553 were closed down and banned, and 3520 were renovated.

In February 2019, Shengze of Wujiang issued the Notice on the Action of Industrial Environmental Renovation after Textile Finishing and Pulping, which clearly stipulates that environmental crimes will be transferred to public security organs for treatment.

In fact, environmental protection is not to prevent production, as long as reasonable emissions can be. In 2018, China's first green tax, mdash; & mdash, & the Environmental Protection Tax Law of the People's Republic of China, was formally implemented to replace the pollution charge system implemented for nearly 40 years.

Because of “ environmental protection tax ” is a fixed tax rate, that is, pay more for more emissions, pay less for less emissions. Therefore, the difference of environmental protection tax burden will bring about the difference of enterprise product price and so on. Environmental tax should be based on & ldquo; survival of the fittest & rdquo; force enterprises to take the initiative to reduce emissions and fulfill their environmental responsibility, so as to promote the transformation and upgrading of products and develop products with higher added value and green and low carbon.

2. Dyeing Price Rising and Downstream Profit Shrinking

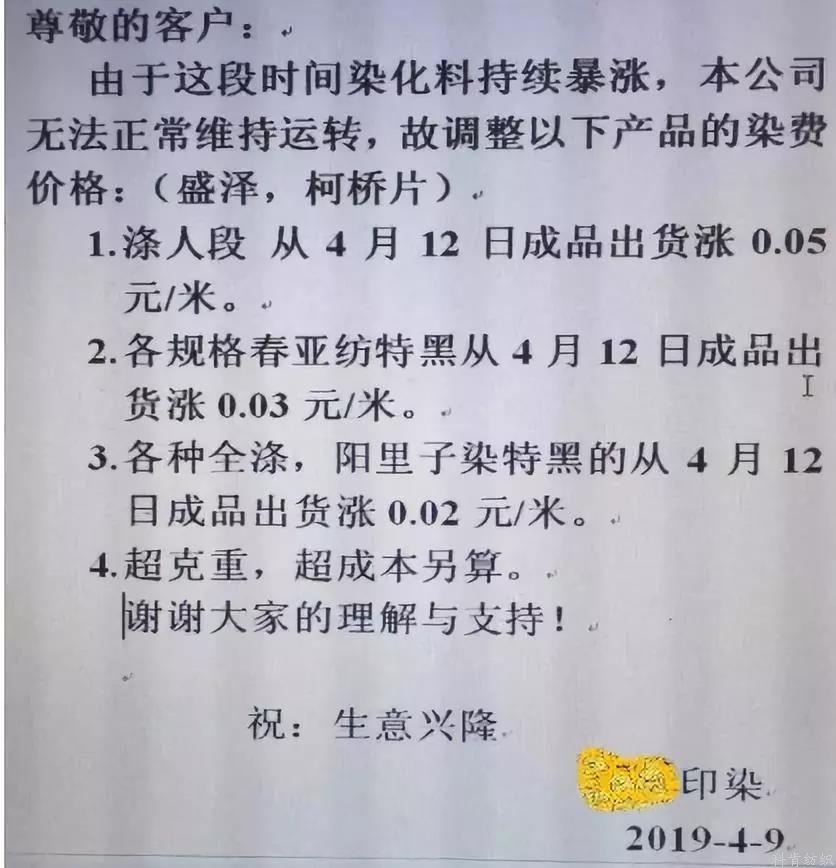

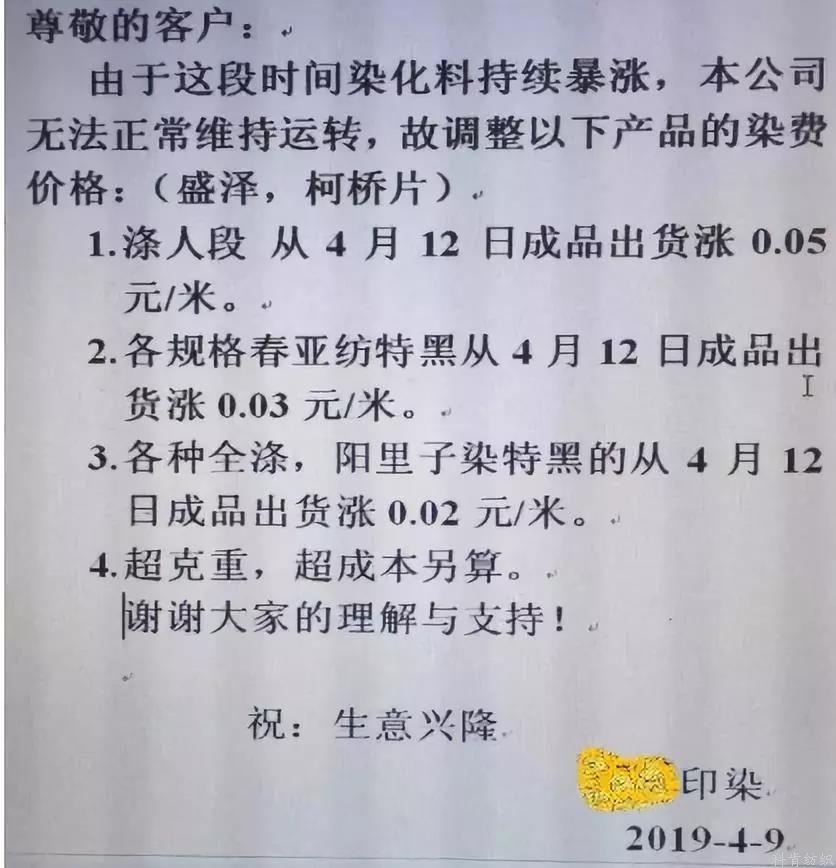

Influenced by the sound water accident, the price of dyes and chemicals soared, and even some dyes were out of stock, which had a serious impact on production. On April 15, a new week began. Dyestuff sales in the circle of friends constantly reminded dyestuff prices to make new adjustments and even indicated that they could do nothing.

The price of dyes has risen dramatically. Nowadays, the cost of raw materials for purchasing dyes has risen from about 10% to 20% to 25% today.

In the whole dyeing and printing industry chain, the dyeing and printing factories are in an embarrassing position, and the upstream dyestuff companies are in a centralized position. Once something happens, the dyestuff companies take the opportunity to adjust the price of dyestuffs. Because the dyestuff enterprises are comparatively advantageous, the dyeing and printing factories, as downstream enterprises of dyestuffs, have a large number of dyeing factories and are in a dispersed state. Faced with the

Many printing and dyeing factories can only accept such a rise in raw materials, raising prices one after another and transferring costs downstream. The rising trend of dyeing fees is obvious, and the profits of textile owners will shrink.

3. The Sino-US Peace Talks Agreement has not been seen yet

Sino-US trade talks are still ongoing, and although the market is hopeful, the agreement has not yet been signed, which mostly worries people concerned about the market. Secondly, the supply of textile raw materials caused by Sino-US trade problems.

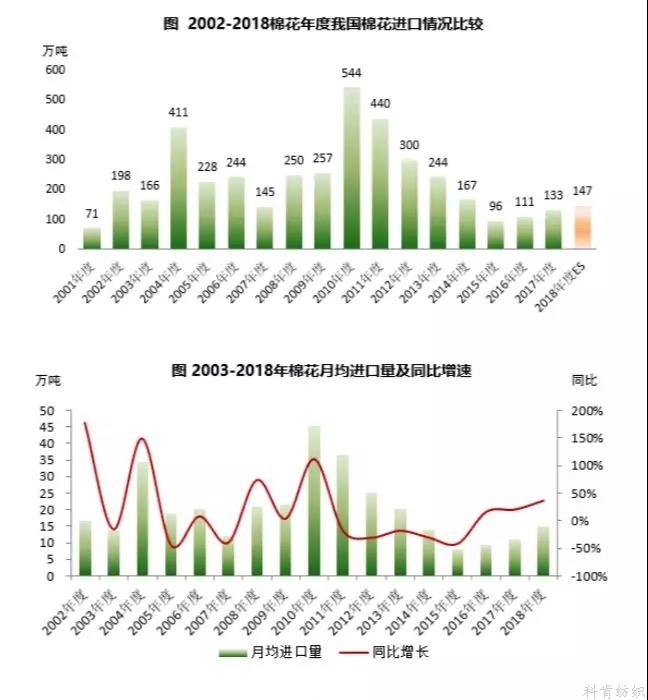

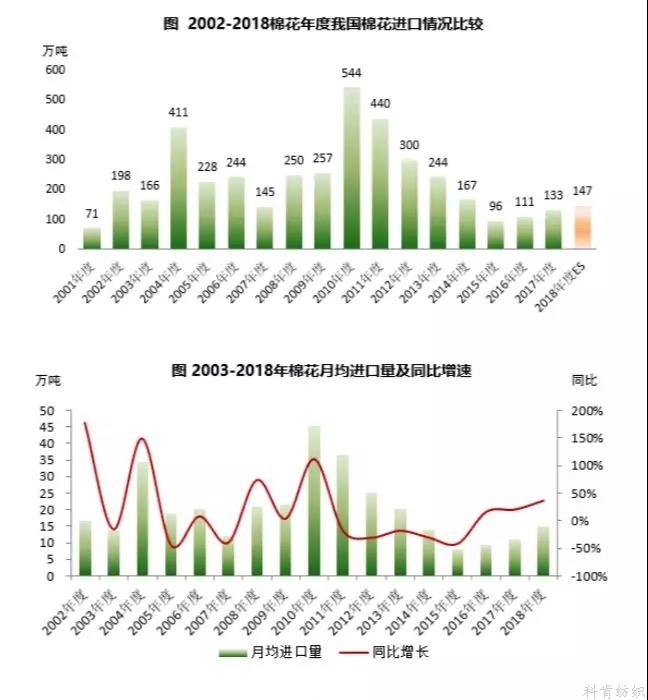

The United States is the world's largest exporter of cotton and China's largest importer of cotton. All along, China's cotton market is in a state of short supply and demand, requiring imports of a certain amount of cotton to meet the demand gap. From January to December 2017, China imported 1.153 million tons of cotton, of which US cotton imports amounted to 506.3 million tons, or 44% of the total imports. From January to December 2018, China imported 1.57 million tons of cotton, an increase of 36.2% over the same period last year.

According to the data from the US Department of Agriculture, China imported 1.5 million bales of American cotton in 2018. According to the weekly export report published by USDA, the contracted imports of American cotton from Chinese buyers in February 2019 showed a sustained momentum, from about 1,000 tons to 4,000 tons, 7,000 tons to 26,700 tons per week, which still showed that the United States imported cotton in China. It occupies a pivotal position. As the shadow of the Sino-US trade war already exists, for some textile enterprises that rely heavily on imported cotton, the key is to choose multi-channel supply.

4. The peak season should be & ldquo; three times & rdquo; signal;

This year's March peak season is not so good. Now it's mid-April and orders are still not improving. Many bosses think that this year's & ldquo; gold, silver and four & rdquo; afraid of yellowing! In fact, the textile market has the saying that the three-year boom cycle has arrived, and then there will be a slowdown in product prices, declining turnover, shrinking production orders, etc. & ldquo; cooling down & rdquo; signal.

For the textile owner, now in this peak season encountered & ldquo; cold wave & rdquo; is unexpected to everyone, from the year after now, every time looking forward to the arrival of orders, but again failed! However, it is not only the problem of orders, but also to pay attention to the fluctuation of raw material prices every day and every week. Every time I receive the notice of price increase, I feel frightened. I keep thinking: I really want to buy the raw materials when they are gone, but this time it is really going to rise? Or tentative?