In the State Council Government Work Report 2019, it is pointed out that a larger tax reduction will be implemented this year, in which the current 10% tax rate for transportation, construction and other industries will be reduced to 9%, which will be implemented on April 1.

I believe that many textile workers are very concerned about when to implement the VAT tax reduction policy, which industries from the current tax rate of 16% to 13%, from 10% to 9%, how to adjust the export rebate rate, and what impact on the textile industry.

On April 4 last year, the State decided to adjust the VAT tax rate from May 1, 2018, and the export rebate rate was adjusted accordingly. As we can see from the above, the reform and improvement of VAT system proposed in 2018 is a framework type. After nearly a month, a specific implementation document was issued, and it was decided to implement on May 1.

The goal of deepening VAT reform proposed this year is relatively clear. With the experience of reforming and perfecting the VAT system last year, it is reasonable to believe that specific policies may be introduced more quickly, probably starting on May 1.

So VAT has dropped dramatically! Which enterprises will benefit? As in last year's practice, the current VAT tax rate for industries including manufacturing industry, which is 16%, has fallen to 13%, while the current VAT tax rate for industries with 10% has fallen to 9%. This is a definite GSP tax cut.

Cotton import costs will be reduced & nbsp;

The value-added tax on cotton imports will be reduced by 1 percentage point to 9% from the current 10%, and the cost of imports will be reduced accordingly. From the perspective of textile industry, the VAT rates of agricultural products and industrial products are different. The VAT rates of agricultural products are reduced from 10% to 9%, and that of industrial products from 16% to 13%. For cotton, it belongs to agricultural products, while polyester short and viscous short belong to industrial products, which means that the tax rate of competitive products (polyester short and viscous short) of cotton will be higher than that of cotton. Therefore, the demand for cotton may be affected by the increased competitiveness of polyester short and viscose short.

Whether cotton is traded domestically or imported or exported, its interest margin is only 1%, that is, 150-160 yuan per ton of operating space. The total tax reduction rate of downstream industrial products (such as cotton yarn) is 6%. The reduction of VAT will bring more profits to enterprises in the short term, or enterprises will have greater bargaining power.

We use the April tariff rate for imports and exports 67101, take 70-150 cents/pound imported cotton price range to calculate separately, it can be concluded that under the new value-added tax rate, theoretical cotton import cost can be reduced by at least 100 yuan/ton.

What is the impact of export tax rebate on foreign trade?

In the medium and long term, taxes and fees have reduced the costs of almost all enterprises, and Chinese goods are more competitive, including textile and garment exports.

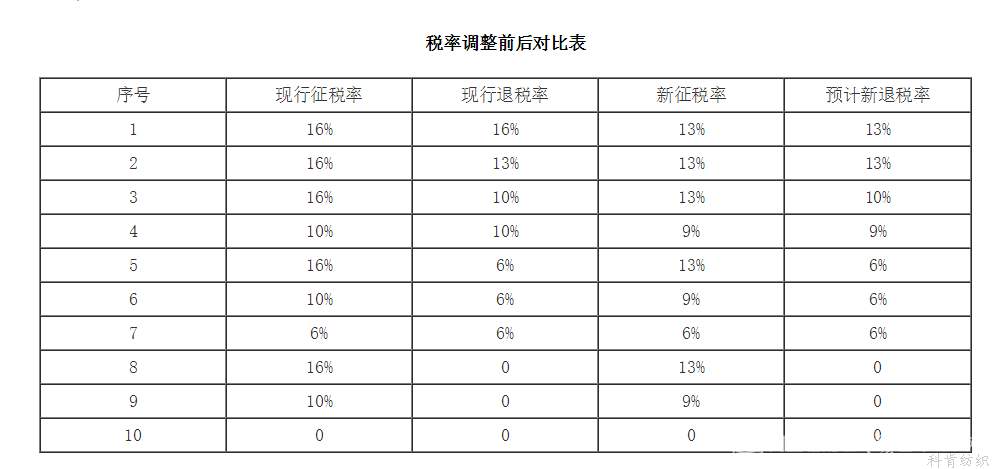

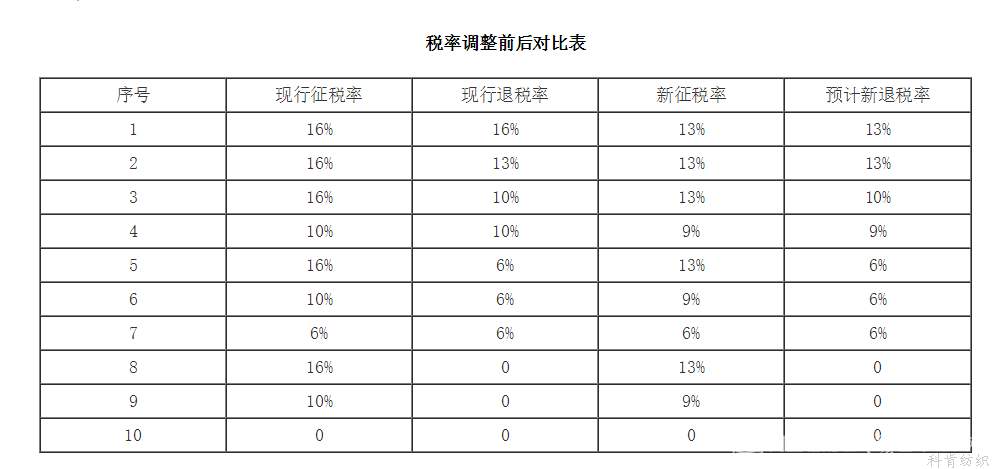

The current VAT export rebate rates are 16%, 13%, 10%, 6% and 0, totaling five categories. Referring to last year's practice, it is expected that this year's adjustment will be 13%, 10%, 9%, 6% and 0, which will still be in the five grades, depending on the official documents issued by the Ministry of Finance and the General Administration of Taxation.

& nbsp; & nbsp;

What is the impact of policy adjustment on export enterprises? Tax rate is the same as tax rebate rate, and all fall by three or one percentage point: although the VAT tax rate is reduced before and after the reduction of the amount of tax rebate, the implementation of a complete tax rebate, but due to the reduction of tax rate, the corresponding reduction of enterprise capital occupation, the impact on export enterprises is slightly more neutral.

The situation that the tax rate falls while the rebate rate does not fall: This situation increases the tax rebate rate, which is beneficial to export enterprises. The decrease of tax rate and rebate rate may have some influence on the purchase and sale price of export goods. Especially for the goods whose bargaining power is weak, the exporting enterprises should make corresponding preparations and take corresponding countermeasures as early as possible. For long-term trade contracts, they should actively consult with foreign businessmen in order to gain their understanding and support.

To sum up, the State Council intends to significantly reduce the VAT tax rate, except for the individual tax rate and the tax rebate rate are 6%, and a few export goods and services without tax rebate and exemption are not affected by export enterprises. Generally speaking, the impact on export enterprises is positive and beneficial.

Cotton spinning enterprises will & ldquo; organic multiplier & rdquo; & nbsp;

The forthcoming implementation of the “ tax reduction & rdquo; to the downstream weaving links with 3-6 points of arbitrage space, short-term demand for speculative inventory increases, the tax reduction advantage is expected to be limited to 1.5 months. For most inland cotton mills, it is advantageous to sell cotton yarn after April 1, while in Xinjiang, it is most advantageous to buy cotton before April 1 and sell cotton yarn after April 1. For downstream fabrics factories, if you buy cotton yarn before April 1 and sell grey cloth after April 1, you can enjoy 13% value-added tax and 16% import tax deduction.

Domestic transactions are best understood as the lower the monthly sales tax rate and the higher the input tax rate, the less tax will be paid. Through the division of VAT withholding in each link, there will be arbitrage space for purchasing raw materials before tax reduction and selling finished products after tax reduction. Cotton ginning mill basically ended seed cotton purchasing, its input tax rate was basically fixed at 10% this year. At present, enterprises with lint cotton can increase profits by selling invoices after tax reduction. Mainland textile enterprises have revised high and low tax deductions due to many local governments, and their input tax deduction rate change time is consistent with the time point of reporting the offset tax rate, rather than the time of invoicing (in addition, different places have different fine-tuning policies). The other links are & rdquo; purchasing raw materials before tax reduction and selling finished products after tax reduction; the short-term interest margin is the largest.

In the absence of external stimulus, China's textile market continues to be in the “ loose supply and cost support ” period, the market is mainly demand-oriented. At present, through tax reduction, short-term profit growth of downstream sectors, especially textile, printing and dyeing industries. Generally speaking, the practice of preparing raw materials before tax reduction and selling after tax reduction is the most advantageous, but there are capital cost and storage cost to make inventory, which will cover the benefits of tax reduction over a long period of time.

& nbsp; & nbsp;

& nbsp; & nbsp;